The Ultimate Pre-IPO Handbook for Accounting & Finance

Introduction

Let’s get the obvious out of the way – going public is a big deal. A very big deal. But it’s not just a monumental occasion for your business and the limitless potential you feel when you ring the bell. As too many companies have learned the hard way, the complexities involved in your pre-IPO run-up can quickly and easily feel completely overwhelming. And that’s not great.

That said, we don’t want to be too dour right off the bat with this Pre-IPO Handbook because there’s plenty you can do as a CFO, leadership team, and organization to smooth out the process. Afterall, going public should be a time for a bit of revelry, right? Pop a few bottles of champagne and let your imagination run wild about the future, at least for a moment or two?

That’s really our intention with this roadmap – to give you the information, insights, and best practices you need for an efficient and, most importantly, successful IPO preparation. And we’re going to do that by categorizing this pre-IPO goodness into specific phases:

- Initial Evaluation Phase: Getting your ducks in a row, assembling your team, and exploring strategy

- Assessment Phase: Determining your current state, target future state, and what you need to put into place to get there

- Execution Phase: Dotting i’s, crossing t’s, tackling the filings and regulatory requirements, and setting your foundation

- Post-IPO Ongoing Support Phase: Ensuring continuity as well as the skills and knowledge you need as a new public entity

As you’re about to see, our insights are comprehensive and hyper-relevant to you, your goals, and your company’s future success as you move toward your IPO. And while we might venture into the weeds here and there, we promise not to get so deep that it stops making sense.

Just remember – you don’t have to feel lost in the IPO woods when the right team is leading the way. So on that note, let’s dive right in.

The initial evaluation phase

So first things first. It takes a village to go public. Well, at least if you want to maintain your sanity, productivity, and make the most of your life as a public entity. In other words, the process starts with the initial evaluation phase – getting the lay of the land and seeking input from the people and teams you’ll need along the way, including:

- Legal counsel

- External auditors

- Consulting teams, bankers, tax professionals, and other key third parties

Obviously, there are legalities involved in going public along with entirely new responsibilities and relationships. This earliest phase of the pre-IPO process is where you start having preliminary discussions with those groups. Laying the groundwork, so to speak.

Although you’ll take a far deeper dive into these relationships in the next phase – assessment – and start rolling up your sleeves to get to work, these initial exploratory conversations provide a much-needed sense of direction and guidance. Essentially, you’re looking for answers to critical questions that you must have down pat before embarking – pun somewhat intended – on your IPO journey.

- Does your in-house legal team, if you have one, have sufficient experience with IPOs?

- Do you have an outside firm that you can rely on to fill in the legal & regulatory gaps?

- Have you engaged with an external auditing firm that you can work well with?

- Do you have contacts in your corporate Rolodex for crucial areas like technical accounting and regulatory filings?

- What investment banking group will you use? Remember, underwriting, roadshows, pricing, and other necessities are just over the horizon.

Put another way, you need the building blocks in place that you’ll rely on in the following months or even years – many CFOs and CAOs start kicking the IPO tires two years before actually going public.

Sure, maybe you already have these contacts in place and it’s just a matter of reaching out to these groups. Alternatively, however, you might be starting from scratch, meaning the process of identifying the right partners and putting the plan in motion can take a good amount of time, from sending out RFPs to thoroughly interviewing every party.

This is just the first of many examples where a forward-looking perspective and an exceptionally organized approach will serve you well across the IPO process. Start early, be thorough, identify your internal weaknesses, and fill those gaps – along with the mile-long list of new responsibilities – with the right people and outside teams.

Educate and Prepare Your People

Speaking of the right people, the pre-IPO process will inevitably create new tasks and stressors for your in-house staff, not just for your accounting and finance functions but, as we’ll discuss later, other groups like IT as well, not to mention your C-suite.

The path you’re about to follow is patently new for many of these people and groups, maybe even most. So there’s a critical education component to your initial evaluation where you not only provide the knowledge your people will need to accomplish their coming responsibilities successfully but also prepare them for the sometimes trying road ahead.

Conducting pre-IPO education and CPE sessions is a great way to establish that solid skill and knowledge footing.

Conducting pre-IPO education and CPE sessions is a great way to establish that solid skill and knowledge footing. Emotional and psychological preparation is just as vital, though, as there will be some long nights, tight deadlines, vats of coffee, and possibly some frayed nerves in the future.

Now, that’s not to say that going public is the financial equivalent of the Battle of the Bulge of storming the beach at Normandy. Far from it. But it does entail an entirely new set of tasks and pressure that your people must deal with on top of their normal, everyday responsibilities. Such a high degree of multi-tasking isn’t an intuitive skill set for most so, before you create an avalanche of burnout and turnover, take the necessary steps in advance to prepare your people.

The pre-IPO assessment phase

Now you have something to build on, and that’s fantastic. But the real work is just starting, making this second phase – assessment – the point in the process where things start getting real.

As we said up top, this is the point in the pre-IPO journey where you determine your current state, define your ideal future state, and put together the framework to get you from point A to point B. Put another way, you’re assessing your IPO readiness and evaluating your capacity to achieve your goals.

This is, at its core, a finance transformation initiative. You're transforming your accounting and finance functions into a flexible, streamlined, and prescient machine. The goal is the ability to quickly pivot in any number of directions depending on the changing needs and directions that might arise in your IPO run-up. And just like any finance transformation, your success rides on three main components – people, processes and systems.

Transforming Your People

Remember those conversations you had with legal counsel, external auditors, and key third parties like advisory and consulting groups in the initial evaluation phase? Well, this is where you expand on those conversations and start evaluating and defining the different roles involved, both internally and externally, across five separate buckets.

Finance and Accounting

Your CFO’s strengths will determine the ideal make-up for the rest of your team. If they happen to have a strong accounting background, then a Director or VP of Finance will be beneficial in bridging any gaps in the finance or investment banking side of the process.

Conversely, if a CFO is well-versed on the finance side, then a CAO with in-depth knowledge of the accounting involved will be important. No matter the structure at the top of the finance food chain, however, other critical in-house groups like FP&A, Investor Relations, and Taxes play an important role.

For accounting, you’ll run into the need for expertise in both technical accounting and SEC reporting along the way. From ever-changing accounting standards to the mountain of SEC filings and everything they involve, you want an accounting team with a diverse set of skills and knowledge to traverse the complex terrain.

Lastly, although ramping up your IA team isn’t typically part of the “pre-IPO” process per se – most companies wait until it’s mandated by the listing exchange – it’s still something you want to keep in mind for the near future. IA will play a critical role in keeping your company’s processes, reporting, and compliance on the straight and narrow. To help you when the time comes, take a look at some of our previous insights on choosing between in-house IA, outsourcing, or combination of the two to see what suits you best.

Governance

You’ll need to establish a Board of Directors, Audit Committee, and perhaps even a Chief Compliance Officer to set and maintain the rules, processes, and practices that keep your operations above-board and on-track. Be sure to take note of the guidelines that might impact your governance from the SEC and stock exchanges.

Legal

Let’s face it. General Counsels are under a pretty intense spotlight given the corporate shenanigans that have gone down in recent decades. Your General Counsel should work hand-in-hand with your board to properly navigate risk as well as ensure compliance and review contracts and transactions.

IT

Your IT team already has a lot on its plate. But there are three little letters coming down the public entity pike that will magnify those responsibilities – SOX. And while we’ll look at SOX more closely in a bit, it’s essential that your IT leadership knows what is required of a public company and makes any necessary changes to ensure SOX compliance.

External

Once again, you’re going to have to rely on outside groups throughout the pre-IPO process. A seasoned, knowledgeable investment banker, a well-fitting external auditing firm, consulting teams that can fill-in knowledge and skill gaps while also helping you address surprises – they’re all critical to your success.

And don’t forget the new world of tax strategies, disclosures, and the previously-mentioned legal requirements. A reputable tax firm and external counsel that functions as your SEC specialists will play an equally vital role.

Collectively, these five groups fuel the people side of your transformation and preparation. They’re on the frontlines each and every day and, suffice it to say, you need to invest sufficient time, attention, and resources to make certain you have the right people in the right roles.

Transforming Your Processes

Even veteran companies that have seen and done everything have room to improve their processes. Therefore, whether you’re a tech startup or a decades-old manufacturer that’s finally decided to go public, there will undoubtedly be areas across your many different processes that can stand to be more efficient, productive, accurate, and reliable.

That’s why evaluating your processes and identifying areas for improvement are so important in this pre-IPO phase. Public companies are under greater scrutiny and have to answer to more stakeholders that wield a more powerful sword than you’re probably accustomed to. And because the variety of processes you use in your operations cuts a mighty-big swath across the spectrum of your teams, it takes time to properly evaluate all of them. To name just a few:

- Financial close

- Accounting and financial reporting

- Internal controls

- Internal audit

- Tax

- Executive compensation

- Governance and board structure

- FP&A

- Treasury

- Investor relations

And honestly, that’s just the tip of the iceberg. But you get the idea – transforming your processes doesn’t happen overnight. But without streamlined, accurate processes, your life as a public company will be unpleasant and likely unsuccessful. And that’s us sugar-coating it a bit.

Transforming Your Systems

Just like evaluating your processes, you also have to take a close look at your systems and see if they’re up to the task. And, also like your processes, your systems spread out across your organization. Sure, your finance and accounting systems are front-and-center as a public company, but they’re certainly not alone.

To properly evaluate this essential component of your transformation into a sleek, efficient public entity, you need to determine if you have what is necessary to successfully address a massive spectrum of needs. That might start with disclosure requirements, financial reporting, and generating the insights your FP&A and accounting teams feed to your leadership which, in turn, inform your company’s strategy.

But an evaluation of your systems also looks at how well they can analyze risk – including in the cyber realm – and handle routine tasks like your financial close. Yes, that’s a wide range of things to evaluate but we assure you it’s time well spent.

Just remember that any transformation is a three-legged stool between people, processes, and systems. Any shortcoming, shortcut, or short-sightedness along the way endangers the integrity of that stool. And public companies need something reliable to sit on.

Determining Your Future State

This part of the assessment phase isn’t so much about wearing a soothsayer hat as it is anticipating the inevitable challenges you’ll face on your one-way trip to IPOville.

To narrow our focus to the accounting side for a moment, nearly every facet of your accounting function will face a challenge or two – or fifty – along the way, including:

- Financial reporting

- Auditing

- Internal controls

- Technical accounting

- Accounting staff

Notice anything special about that list? Maybe how the same things keep coming up in our discussion thus far? There’s a reason for that – these pillars of your accounting function are under more scrutiny, face new and significant challenges, and require sufficient attention and answers for your IPO to be successful.

So while the evaluation of your people, processes, and systems revealed gaps in your ability to address such challenges, this focus on your future state reveals the challenges themselves. Like the PCAOB audit, for example, or meeting the far higher requirements in your reporting to adhere to both GAAP standards and the SEC.

These hurdles, along with seemingly countless more, are all potential roadblocks between you and that ideal future state – a successful public company. But there’s good news that segues this discussion directly into our next point on the assessment phase. If you’ve been diligent thus far, a little bit of elbow grease and a whole lot of planning and attention to detail will propel you toward that future state.

Gap Analysis and Action Planning

Knowing where you are, where you want to be, and assembling a game plan and the tools to get you there might seem like an obvious first step. But just because an answer seems intuitive, especially when dealing with something as complex as an IPO, doesn’t render it ineffective. Think Occam’s razor – oftentimes, the most straightforward approach is the best approach.

That’s what makes gap analysis such a particularly powerful tool. By analyzing the difference between your current and future states – along with the many insights you’ve picked up thus far in the pre-IPO process – you can start assembling action plans to move forward.

But there’s a bit of an art to action planning and remediation that trips up even the most organized and motivated of companies and financial leaders at this stage. Chances are, you’ve uncovered a lengthy list of things to address by now, one that’s so involved, it can feel overwhelming or even chaotic.

Our advice is to begin addressing the deficiencies from your gap analysis by identifying and prioritizing the most essential activities. Don’t confuse this with knocking out the low-hanging fruit, though, because your most essential activities could very well be the most involved as well.

Our advice is to begin addressing the deficiencies from your gap analysis by identifying and prioritizing the most essential activities. Don’t confuse this with knocking out the low-hanging fruit, though, because your most essential activities could very well be the most involved as well.

Basically, as you begin action planning and assembling a roadmap for the path ahead, you should align your resources with what you deem most important. Sure, that might mean investing in a comprehensive financial reporting system rather than the shiny, high-end stock compensation software you’ve had your eye on. But that’s okay.

...you should align your resources with what you deem most important.

That type of thought process is what prioritizing around your biggest, most vital needs is all about. Identify what’s absolutely crucial for the near future, develop an action plan to address those needs, attack it with gusto, and then head toward the next set of must-haves or must-do’s. Otherwise, it’s too easy to dilute your efforts by trying to do too much at once.

IPO Considerations

The final component of the assessment phase is the most technical thus far. Up to this point, we’ve concentrated on more behind-the-scenes actions that are crucial to any successful IPO. However, there are obviously many decisions you’ll have to make about the nature of the IPO itself.

Determine Your Issuer Type

Are you a domestic or foreign issuer? How familiar are you with the JOBS Act and the newest type of issuer – Emerging Growth Companies (EGCs) – it created? Or the recently expanded guidelines to determine who qualifies as a Smaller Reporting Company (SRC).

Yes, we know that the sudden avalanche of acronyms can be a bit off-putting but the differences between the issuer types and what they mean for you can be significant. Scaled disclosures, SOX relief, and even a far more relaxed approach to accounting standard adoption are all possible, depending on your issuer type.

Types of IPOs

Your issuer type isn’t the only somewhat nuanced factor involved in your IPO. In fact, the type of IPO you use is another key variable. To keep this guide more British novella than Russian novel, though, it’s probably best just to do a quick rundown of the different IPO types.

- The sale of newly issued common shares to the public registered on Form S-1. This is the most common type of IPO.

- The exchange of debt securities previously issued in a private transaction (144A) for registered debt securities via Form S-4.

- The registering of currently outstanding equity securities on Form 10.

- The distribution of shares in a spin-off transaction by a public company, also registered on Form 10.

- The registering of securities issued by real estate investment trusts (REITs), including “blind pool” offerings, potentially by Form S-11

- The registering of new securities issued by a special-purpose acquisition company (SPAC) on Form S-4 through a joint registration and proxy statement.

- Note that if a SPAC registers no new securities, it still files a proxy statement on Schedule 14A

Granted, that’s just a quick run-through of the different issuer and registration types, but it’s enough to give you an idea of the scope of what you’re facing. And now that our assessments are done, it’s time to put your planning into action and see the rubber hit the road.

The execution phase

There are going to be many moving parts in the execution phase of the pre-IPO process, all going at once. Without proper supervision and guidance, all of those moving parts can quickly start looking like something between Lord of the Flies and a circus. And that’s not great.

But how does a circus prevent itself from devolving into pure chaos and anarchy? With a ringleader, of course. And throughout your pre-IPO efforts, a project manager is your ringleader, serving as a liaison between all involved parties, both internal and external.

As you can surmise by the lengthy list of parties we covered above, project management isn’t an easy task. It’s success is ultimately defined by the communication it infuses across the many people, teams, locations, and organizations involved in your IPO.

Without effective communication, bottlenecks and information silos form, workflows slow to a trickle, and you needlessly burn through precious time and resources that you’re better off devoting elsewhere. And as you’ll see from the following components of your IPO execution phase, this is neither the time nor place to be inefficient because there’s much work to do.

SEC Filing Requirements

As we discussed in the assessment phase, your IPO type determines which registration statement you’ll use. But rather than break down the differences between S-1 and Form 10 registrations, let’s stay high-level and focus on some of the common disclosures you’ll need in your IPO registration statement.

- Prospectus Summary, aka “the Box”

- Risk Factors

- Use of Proceeds

- Dividend Policy

- Capitalization

- Dilution

- Selected Financial Data (SFD)

- Management Discussion and Analysis (MD&A)

- Business

- Executive Officers, Directors, and Principal and Selling Stockholders

- Executive Compensation

- Description of Capital Stock

- Underwriting, Plan of Distribution

- Experts

- Financial Statements

- But wait, there’s more!

Naturally, this list speaks to one of our previous points regarding your reporting – it’s a whole new world as a public company. MD&A, pro formas, S-1s, S-4s, proxy statements, and more – these are all filings you need to get right the first time.

Also, keep in mind that we’re only talking about your registration statement right now, not your ongoing reporting requirements. When you include additional registration statement considerations like the different requirements between non-EGC and EGC filers – read all about that and more in the SEC’s Financial Reporting Manual – the importance of in-house expertise or an experienced outside party – or a combination of the two – becomes readily apparent in your SEC filings.

US GAAP Financial Reporting

Now let’s zoom in on your financial statement preparation and disclosure drafting, yet another complex facet of this execution phase that is probably new to much of your staff. Once again, we’ll hit the highlights to spare you some retina strain but, suffice it to say, there’s a lot to take into consideration.

- Start by determining which years to present based on your EGC determination

- Remember that you must present prior and current years to satisfy SEC reporting requirements

- All annual periods presented must have audited financial statements following PCAOB standards, requiring additional testing and a newly issued audit report

- Interim periods presented must have reviewed financial statements following PCAOB standards as well

- You’re also going to need additional disclosures along with more robust disclosures for these accounts or transactions, most commonly:

- Goodwill

- Intangible Assets

- Segment Reporting

- Earnings per Share

- Acquisitions

- Income taxes

- Finally, your disclosures must include your transition to new accounting standards effective for public companies, unless you qualify as an EGC

Seems like with so much happening on the accounting and reporting side of the fence, you’d want some sort of policy in place to act as a guide, right?

Accounting Policy Development

Well, it just so happens that an accounting policy is precisely what you need to keep everything inline and ontrack. Granted, most private companies have some level of accounting policy documentation already in place. However, if developing such a policy remains on your to-do list, just remember how important it is to have formalized documentation around your accounting policies and procedures. In other words, don’t dilly dally and get to work.

...just remember how important it is to have formalized documentation around your accounting policies and procedures.

SEC Pre-Clearance

Once you file your registration statement with the SEC, you’ll get comments back that you’ll need to address. That’s part of the SEC’s pre-clearance process, where you’ll need to speak to often complex financial reporting and execution matters.

Note how we used complex as an adjective in the previous sentence. These aren’t your run-of-the-mill follow-ups. They’re intense and in-depth. And most private companies simply lack the level of expertise required to effectively address these complex questions and comments.

Therefore, harkening back to the initial evaluation phase, this is an opportune time to put your diligence to work and engage with outside specialists that understand this pre-clearance process inside and out. They can step in and help you get these matters cleared with the SEC by working in conjunction with your SEC counsel. It’s efficient, effective, and helps you successfully check yet another box as you get closer to your IPO.

Therefore, harkening back to the initial evaluation phase, this is an opportune time to put your diligence to work and engage with outside specialists that understand this pre-clearance process inside and out. They can step in and help you get these matters cleared with the SEC by working in conjunction with your SEC counsel. It’s efficient, effective, and helps you successfully check yet another box as you get closer to your IPO.

SOX Readiness

You knew this point was coming. You could feel it swelling in the background throughout this roadmap, right? Ready to burst at the seams? Yes, SOX is the 800-pound IPO gorilla, the elephant in the public entity room. And while a thorough discussion on preparing for SOX is a hefty tome in and of itself, it’s a topic we’ve covered before in our Roadmap to Implementing SOX Compliance as well as an introductory blog on the topic.

Still, to give you a clear picture of everything involved in going public, we want to cover some of the main points from those previous insights.

The Sarbanes-Oxley Act of 2002

In a nutshell, SOX focuses on two essential tasks – preventing corporate fraud and providing investors with the accurate information they need to base their decisions on. It applies to all publicly traded companies based in America as well as all wholly-owned subsidiaries and public foreign companies that do business in the US.

Now that you’re on your way to becoming a public company, it’s imperative that you keep these four compliance requirements under SOX top-of-mind:

- Your CEO and CFO are responsible for the accuracy, documentation, and submission of both your financial reports and internal control structure to the SEC under Section 302.

- As discussed in Section 404, management must state that it's responsible for maintaining sufficient internal controls for your financials.

- You must have formal data security policies in place, communicate those policies, and enforce them consistently. This includes a thorough data security strategy that protects financial data you use during normal operations.

- You must maintain and provide documentation of your continuous compliance, monitoring, and measuring of your compliance objectives.

Shining a Spotlight on Section 404 and Your Internal Controls

The health of your internal control environment lies at the center of an absolute SOX pillar – Section 404(b). This is the language within the legislation that establishes a gauge for you to monitor the effectiveness of your internal controls for financial reporting.

That’s not to say, however, that every internal control must be SOX compliant. That’s where determining materiality comes into play, a task that your auditors can help you with by advising on what benchmarks to use for your SOX compliance. From there, you need to identify the risk of material misstatements as well as the controls that will help you mitigate that risk.

Since you’re probably not too familiar or comfortable with SOX compliance, we advise you to start the process as early as possible. Remember, SOX is just one part of the pre-IPO process – albeit a crucial one – so starting early gives you enough time to handle the million other things on your plate.

Remember, SOX is just one part of the pre-IPO process – albeit a crucial one...

Internal Audit Support

Since we were just talking about SOX and your internal controls, this seems like the perfect time to discuss your internal audit function, or lack thereof. Whether you already have an in-house IA team in place or are thinking about outsourcing it, you still need to start with a solid foundation.

This is another area where outside specialists can be especially helpful, evaluating your internal control framework and where you need additional controls in your accounting and financial reporting. From there, you can build-out an IA team that will establish and maintain a compliance and control methodology, even in the face of ever-evolving compliance requirements.

Process Improvement

In what probably seems like ages ago, we first mentioned how vital your processes are back in the assessment phase, explaining how they’re key to the transformation you need to walk the IPO road. And to reiterate one of those previous points, there’s always room for improvement on the process front, no matter how long you’ve been in business.

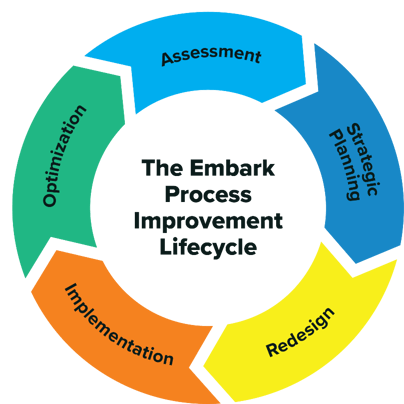

That constant improvement was the focal point for another of our guides, The Finance & Accounting Process Improvement Lifecycle. So while we encourage you to read that piece for a more in-depth look at improving your processes – an essential part of this execution phase – a quick summary reveals the five main stages we use across the improvement lifecycle:

Not to toot our own horn but if you really get to understand our lifecycle and implement it into your operations, you’ll always have a clear view of what you need to improve in your processes. Likewise, you’ll also have a battle-tested method for redesigning, implementing, and continually optimizing them. Obviously, it goes without saying how important reliable processes are to both your IPO preparation and your post-IPO life.

Not to toot our own horn but if you really get to understand our lifecycle and implement it into your operations, you’ll always have a clear view of what you need to improve in your processes. Likewise, you’ll also have a battle-tested method for redesigning, implementing, and continually optimizing them. Obviously, it goes without saying how important reliable processes are to both your IPO preparation and your post-IPO life.

Believe it or not, that’s the end of the execution phase of this pre-IPO roadmap. Once you hit this point, you’ve taken the steps necessary to ring that bell and, even more importantly, feel good about it. Yes, there are plenty of other things involved like your roadshow and pricing but, at least from an internal perspective, completion of the many different things we’ve discussed sets you up for success.

Now, does that mean that your work is done and it’s clear sailing from here on out? Nope. But as a bonus, we have a few insights for the post-IPO road as well.

the post-ipo support phase

Much of this “bonus” phase builds on what we’ve already discussed. Sure, you’re technically a public entity by now but it’s not like there’s a concrete block wall between your pre-IPO and post-IPO lives. As a matter of fact, if you squint a bit, you probably won’t be able to tell much difference between the two, at least if you followed our roadmap to get you here.

The point is, things like technical accounting, SEC reporting, and SOX compliance are still centerpieces to your ongoing operations. The only difference, really, is that they hopefully don’t seem quite so foreign anymore.

Still, like it or not, the inherently dynamic nature of accounting standards and compliance means you’ll always have to be on your toes. Taking that a step further, it also means you’ll always have a need for specialists you can rely on for ongoing support, leveraging relationships for critical needs that you hopefully cultivated during the pre-IPO evaluation phase.

Ongoing Support and Team Continuity

How many major accounting standards have changed over the past decade? A lot. That change continues to this day and will keep on trucking ad infinitum because that’s what GAAP does – it evolves. And that evolution means your day-to-day accounting is often in some state of flux. For a newly public company, that can be an unnerving source of instability.

Further, when you throw accelerated filing requirements, setting up your SOX environment, and ongoing SEC comment letter responses, your post-IPO days are indeed heady ones. If we were to do a back-of-the-envelope sketch of the different areas you’ll need a post-IPO support system for, it would include:

- On-call technical accounting support

- Implementation of new accounting standards

- Accelerated external reporting requirements – i.e. 10-Ks, 10-Qs, 8-Ks

- SOX audits, including internal control testing and remediation

- Initial standup, including process narratives, flowcharts, walkthroughs, design and implementation testing

Remember, from the moment your registration becomes effective, you’re on the 10-Q and 10-K filing clock. In fact, the 10-Q for newly public companies is due the later of 45 days after the effective date or your actual filing deadline. So needless to say, it’s critical that you hit the ground running.

But that’s what makes Embark such an invaluable partner. From technical accounting to SEC filings, internal controls to finance transformation, our team of experts fill in the knowledge and skill gaps that you’ll undoubtedly face. And that continuity in ability – whether you’re short-staffed or simply lack the in-house knowledge – could very well determine your future success.

In short, the right partners make all the difference. And that’s what sets Embark apart from the rest – the right team with the right experience for your needs, culture, and vision. That’s Embark.

Let’s stay connected

Subscribe to our blog to stay updated on latest trends, insights, and, oh yeah ... staying happy.

Download PDF

Fill out the form below to download a PDF of this guide.