The Finance & Accounting Process Improvement Lifecycle

Introduction

Think back to the most efficient, effective finance and accounting teams you’ve ever seen. Were they the sort that seemed content to rest on their process laurels? Probably not. Successful teams never stop improving, even when they’re already a well-oiled machine.

But process improvement isn’t always obvious or even intuitive. Sometimes, all it takes is a subtle, nuanced tweak here and there to streamline your workflows, improve your accuracy, and deliver the insights your decision-makers need to lead your organization to the top of the competitive mountain.

Of course, other times, it’s a lot more involved than that, where you need to get down to the process studs before you start rebuilding. So which camp does your organization fall under, you ask? And what can you do to improve your teams’ processes? Well, that really depends on where you are in the process improvement lifecycle which, not coincidentally, is exactly what we’re about to dive into.

Throughout this latest guide from Embark, we’re going to examine different terms, tools, and techniques that, collectively, can vastly improve your finance and accounting processes

Throughout this latest guide from Embark, we’re going to examine different terms, tools, and techniques that, collectively, can vastly improve your finance and accounting processes – not to mention some key best practices and insights along the way. And we’re going to accomplish all of this by walking you through some specifically-chosen topics, including:

-

What Is Finance/Accounting Process Improvement?

-

Process Problems & Challenges in the Finance & Accounting Function

-

The Most Common Finance & Accounting Processes Needing Improvement

-

The Embark Process Improvement Lifecycle: How to Improve Your Finance & Accounting Processes

-

Finance & Accounting Process Improvement Ideas and Tips

Ready to get your finance and accounting functions in tip-top shape? Because Embark is ready to get you there. So let’s begin!

What is finance/accounting process improvement?

Think of your processes as the drivetrain in your car – they make your ride move. And while everything might look okay from the outside, processes that are inefficient, misaligned, or flat-out missing will prevent that car from driving as fast, smooth, or efficiently as it should. When things are especially dour, your processes will strand your accounting and finance functions – and, therefore, your entire organization – on the side of the operational road.

Put another way, finance process improvements streamline your workflows in some way...

Put another way, finance process improvements streamline your workflows in some way, often through technology, to automate manual tasks, increase accuracy and speed, and just generally drive better business intelligence for your decision-makers. Improved processes are the rising tides that lift all groups, teams, data, and tasks impacted by them in some way.

Process Problems & Challenges in the Finance & Accounting Function

Going back to our spiffy automotive comparison, your car isn’t lacking for places for the drivetrain to wreak havoc. From the transmission down to the wheels, if all of those moving parts don’t work in harmony, one can bring everything to a screeching halt. Of course, the same is true for the many individual processes across your finance and accounting functions. With so many dependencies, a single faulty process can quickly impede the whole team and enterprise.

And while every company is different, there are a few problems and challenges that tend to be the most common factors driving the need for process improvement in organizations.

Inefficiencies:

As you probably noticed, “efficiency” is a term we’ve already used a number of times – and for good reason. When things like information silos, workflow bottlenecks, and other inefficiencies rear their ugly head, they’re a death knell for accurate, timely reporting and team morale.

At a more granular level, when processes are particularly repetitive or dependent on mind-numbing, time-consuming manual work, you’re relegating an intelligent, once-motivated member or members of your team to about the same engagement levels of a robot on an assembly line. And as we’ve discussed in the past, engagement levels across your team directly correlate with productivity and, ultimately, success.

Designation of Duties:

Too many cooks in the kitchen. Or not enough hands on deck. In either scenario, you’re asking for trouble with a team that either doesn’t know how to stay in its lanes or who is responsible for what.

Without a clear designation of the many roles and responsibilities in finance and accounting, employees don’t know what to do, who to turn to for help and approval, or how their work fits in with someone else’s or the bigger picture. And as you might have guessed, that leads to both redundancies and gaps in the workflow, both quite destructive in their own way.

Lack of Uniformity & Consistency:

Finance and accounting rely on data from your operations. And sometimes, that data and the corresponding documentation can look downright Himalayan in nature – vast, endless, and overwhelming. Without the ability to effectively manage that mountain of information, your teams won’t know what’s coming or going.

Of course, the inability to manage and analyze data will directly impact your audits as well, especially in companies still relying on manual systems to sort through, categorize, store, and track their business information. It’s easy to see how a lackluster data management system cascades all the way down to stakeholders and even customers.

Slow Processing Speed:

Business moves fast, and so does the marketplace. Companies that are unable to pivot on a dime are at a distinct disadvantage, especially when so much uncertainty continues to blanket the environment. Thus, when you’re slow to process tasks and data, it means you’re also slow in providing key insights leadership needs to steer your organization forward.

But slow processes aren’t just about glacial reporting and insights. They can also lead to unhappy vendors and other third-parties that depend on your ability to quickly get things done. If significant enough, you could soon find your company’s reputation taking a serious hit, potentially affecting your standing on Wall Street, Main Street, and most of the roadways in between.

Lack of Data Transparency:

The bigger your organization is, the more susceptible it is to the lack of data transparency and oversight that comes with manual accounting systems. Imagine you’re a staff accountant tasked with keeping hundreds, sometimes thousands of invoices, work orders, and accounts in proper working order. Do stacks of paper three-feet high or file cabinets busting at the seams sound like an efficient way to manage all of that? Nope.

The most common finance & accounting processes needing improvement

So that’s a list of the most common challenges, issues, and factors negatively impacting an average company’s processes. But let’s zoom in a bit further and see who and what those factors affect in your organization.

Accounts Payable & Receivable

Slow, unreliable, and inaccurate processes are especially troublesome for these two groups. For AR, not understanding who owes you money and when they owe it to you can reduce cash flow to a trickle at a time when many companies are desperate for liquidity.

Conversely, as we said above, not paying your own bills on-time can really do a number on your reputation and good-standing with outside parties that might be critical for your success.

Cost Management

Between employee-related expenses, cost allocation, and reporting demands, amongst others, being able to successfully manage your costs to maximize cash flow can make or break everything from your capital allocation to basic solvency, especially when there’s so much risk in the environment.

Financial Planning & Analysis (FP&A)

Is there a group more dependent on timely, relevant information than your FP&A team? Slow, manual, inaccurate processes generate outdated, unreliable information, leaving FP&A unable to provide the nuanced insights leadership needs to properly steer the organizational ship.

Audit and Compliance

Auditors require clear, clean, wide-open paper trails to do their jobs properly. Naturally, inefficient, ineffective processes that rely on manual work can leave those paper trails messy and filled with errors.

The same goes for compliance and regulatory demands that require you to dot every i and cross every t – relatively straightforward responsibilities that can quickly feel overwhelming without smooth workflows and clean data generated by neat and tidy processes.

HR and Taxes

Last but not least, your processes can dramatically impact how well HR addresses often complicated responsibilities like payroll, stock compensation, and benefits. For instance, something like a vesting schedule, as simple as it might appear, depends on a number of processes operating in the background to calculate, maintain, and track strike prices, basis information, and other critical data.

Similarly, your organization’s income taxes rely on accurate data stemming from seemingly countless different corners of your enterprise. And if there’s anyone you don’t want to get on the wrong side of – especially for something like defective processes – it’s the taxman. And we’ll leave it at that.

The Embark Process Improvement Lifecycle: How to Improve Your Finance & Accounting Processes

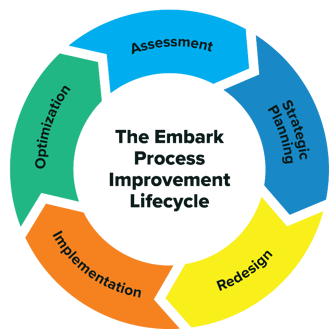

Now that we have the doom and gloom out of the way, let’s start exploring ways to improve your finance and accounting processes. Here at Embark, we frame the conversation around the Process Improvement Lifecycle – a series of stages that will help you identify what you need to improve your processes and, more importantly, start realizing the benefits.

Before we take the plunge, though, we wanted to make sure we’re clear about a very important notion – your processes don’t have to be old and dilapidated for you to benefit from a jaunt through the improvement lifecycle. Revisiting our opening salvo, truly successful organizations never stop improving, even when – or, more accurately, especially when – they have their operational act together.

With that out of the way, let’s look at the Embark Process Improvement Lifecycle across its five main stages:

Stage One: Assessment – Getting the Lay of the Process Land

Depending on the current state of your processes, this could very well be the most intricate of the stages. The goal with your assessment is to generate an exhaustive, meticulous, granular understanding of what you do well, where you fall short, and to begin putting the puzzle pieces together which, together, serve as the foundation you need for improvement.

Identifying Areas to Improve

A journey of a thousand miles begins with a single step. In this case, that step is identifying the weak spots within your processes that determine the path for the entire lifecycle.

While improved accuracy might be the lowest-hanging fruit, don’t discount the impact of sheer volume or other factors dragging down your process efficiency. Maybe you’re integrating multiple acquisitions, you’ve grown or divested units, or even changed business lines – whatever the case, your processes might not be keeping up with your organization’s dynamics.

Conducting thorough walk-throughs of all of your processes and getting a lay of the process land, while not exactly an afternoon in a thrill park, will identify where you need to improve and create a baseline for you to work from. Or maybe you prefer to think of it as a heatmap. Either way, you’re gathering an in-depth understanding of the issues at hand, all the way down to their roots, along with the ability to articulate them.

As a rule of thumb, highly transactional processes or those that require several people to complete – like reporting – are typically the biggest, most obvious areas needing improvement. However, assuming you’re thorough with your assessment, you’re bound to uncover more subtle process potholes, too.

As a rule of thumb, highly transactional processes or those that require several people to complete – like reporting – are typically the biggest, most obvious areas needing improvement.

GAAP Assessment

Obviously, process improvement in accounting and finance has additional requirements that other teams don’t. So while your marketing and HR departments will also greatly benefit from improved efficiency and productivity, those fine folks don’t have to worry about what financial regulators and the FASB have to say. But you do.

Thus, you always want to keep your eye on the technical side of things as you conduct your assessment. Streamlined processes are fine and dandy but won’t do you much good if they don’t align with US GAAP. That’s what makes a thorough assessment of both your current processes and your redesigned ones relative to accounting standards such a critical component of the lifecycle.

Stage Two: Strategic Planning

That leads us to the second step of the Embark Process Improvement Lifecycle – strategic planning. Or maybe a more accurate term is holistic strategy. Here at Embark, we combine the detailed attention of an auditor with the enterprise-wide, global perspective of in-house leadership while conducting an assessment. The result is technically proficient and adheres to standards, but still incorporates the bigger picture view that connects your accounting processes to your overall business processes.

Obviously, our holistic strategy isn’t relegated to assessments, though. Something like SOX compliance requires a very particular skill set and knowledge base to truly understand how your processes drive the bus, impacting everything from HR and IT to, of course, your accounting and finance teams.

We combine the detailed attention of an auditor with the enterprise-wide, global perspective of in-house leadership while conducting an assessment.

Now, while we wouldn’t blame you for thinking that you’re reading a not-so-subtle ad for Embark right now – FYI, we’re amazing – our actual point is this: effective process improvement in accounting and finance requires a unique, all-encompassing strategy that isn’t exactly commonplace.

Therefore, whether you choose an in-house team to lead your improvement initiative or a third-party, just make sure they incorporate the specific needs across your accounting and finance functions as they guide your strategy and redesign your processes – more on that in a bit. Besides the technical aspects, a third-party with first-hand knowledge of the inevitable bottlenecks and process dependencies can be an absolute game changer for everyone involved.

Best Practices and Your Plan of Attack

Now that you’ve identified your weak points, it’s time to equip yourself with the tools you need for the remainder of the process improvement lifecycle. Aside from the avalanche of best practices we’ll be closing out this guide with, this is also an opportunity to integrate concepts and methodologies that will help you optimize efficiency and cut the proverbial fat.

Lean methodology, Six Sigma, Kaizen, and countless more – they all provide essential guidance in your quest to drive increased efficiency, productivity, and accuracy through improved processes. Most importantly, these fundamental concepts and philosophies can help ensure you don’t lose sight of the forest through the trees.

Put another way, your strategy must keep the connectivity between your team, other departments, stakeholders, and customers in-mind as you proceed. Process improvement, even when it focuses on accounting and finance, doesn’t operate in a vacuum and impacts scores of others.

Likewise, with so many of the issues with processes stemming from manual tasks, technology also plays a pivotal role in your strategy development. Automating your processes wherever and whenever possible will increase accuracy, speed, and the flexibility you need to meet the demands of your decision-makers.

From your month-end close to daily tasks in AP and AR, technology can transform nearly every component of the record-to-report workflow through streamlined processes. Also, remember every minute that your team doesn’t spend on those manual processes is a minute they can devote to other, more value-adding, innovative tasks.

Remember every minute that your team doesn’t spend on those manual processes is a minute they can devote to other, more value-adding, innovative tasks.

Create Your Roadmap

At this point in your strategy development, you know where you’re starting, have identified your goals, timeline, budget constraints, and ideal future state, and assembled the tools and insights to get you there. Now it’s time to put the rubber to the road and create a map to guide your way.

This step, at least from a project management perspective, is similar to other initiatives across your organization. You’ll need someone to take the lead and supervise the project, bring process owners and others with key insights into the fold, and develop a cohesive gameplan to, once again, get you from point A to point B.

Establishing and monitoring progress against timelines will be instrumental in keeping you on-track and on-schedule. Meanwhile, you want to be sure you continually address the bigger issues, prioritize the right tasks, and optimize your resources. Remember, everyone involved still has their regular responsibilities to manage so creating and sticking to an optimized strategy is critical.

Stage Three: Redesign

This is the point where the theoretical starts transforming into reality. Taking what you’ve accomplished so far with your assessment and strategy – including the insights, best practices, and roadmap you’ve developed to reach that ideal future state – we’re now going to convert all of that potential energy into kinetic energy.

But here’s the thing about redesigning processes that might make you feel better or worse, depending on your outlook – there are roughly one million ways to go about it. And an approach that might work well for one company could be a fiery pit of despair for another. Therefore, if you choose to tackle this step on your own, our best advice is to follow a course of action that suits you, your team, and resources well.

That said, most organizations find that a whiteboard-type approach to redesign is most effective, where you take your strategic planning, map out your processes, and figure out how to execute them and, thus, make them operational. Also, keep in mind that it takes a village to raise a sound process, so be sure to involve all necessary parties in these whiteboarding redesign sessions.

And as a capper to your redesign, gaining buy-in from your leadership is critical to ensure you’ve covered your bases before moving into the implementation phase. There’s absolutely nothing efficient about traveling a mile or two down your roadmap only to realize you need to reverse course and go in a different direction.

Our best advice is to follow a course of action that suits you, your team, and resources well.

Stage Four: Implementation

Implementing your redesigned processes is largely about educating your people on them, beginning with a simple announcement that the redesign is complete and you’re ready to roll. From there, you want to clearly communicate which templates your team should use.

Given how averse most people are to change – we’re looking at you, staff accountants – formal training sessions can be your best friend during implementation. This way, you can provide everyone with documentation, walk them through the redesigned processes, and ensure they’re ready, willing, and able to accept them as the norm.

After those training sessions, it’s important for your frontline and mid-level managers to continue to gently remind everyone how important the new processes are to your team and organization. As you can see, implementation takes most of the factors that drive effective change management and distills them into a single stage.

Stage Five: Optimization

Now it’s time to enjoy the fruits of your labor. Well, sort of. Wouldn’t it be a shame to devote all of that effort into something that ultimately didn’t work as you planned? That’s why this fifth and final stage of the Embark Process Improvement Lifecycle is so important.

Process improvement isn’t a set-it-and-forget-it kind of thing. Because things change. Personnel, technology, the marketplace, your customer base, your goals – none of them are set in stone. Thus, continually monitoring and optimizing your processes will not only prevent you from having to reinvent the process wheel again in the near future, but also ensure they continue to run on all cylinders.

To begin with, you probably identified some KPIs back in the strategic planning stage of the lifecycle. If you didn’t, then this is a great time to choose some insightful metrics that will help you keep a pulse on the relative health of your redesigned processes.

For example, if your goal was to speed up a specific process, then simply monitoring time will tell you if your redesign continues to be effective. If you start to see a negative trend, then you need to revisit that process and make needed changes as you go. This is another area where a third-party can help, especially if it played an active role in the lifecycle and is already familiar with your processes.

To ensure your optimization continues as it should, try scheduling a “check-in” with your redesigned processes after two weeks, 30 days, a quarter, six months, and a year thereafter. Use your chosen KPIs as the financial canary in the coalmine, signaling when something goes sideways and it’s time to roll those sleeves back up and figure things out.

For smaller miscues that don’t necessarily require a new assessment but still warrant some attention, a simple Google Doc that collects input from your managers can help you monitor if any small tweaks are necessary. Also, collecting feedback from your team is a good idea for any number of reasons, including the relative health of your processes.

No matter what, just don’t scrimp on the time and resources you devote to this optimization stage of the lifecycle. Once again, things change, especially with so much uncertainty out there. Between employee turnover, new business lines, M&A, and just the natural evolution of your organization, change catalysts are a constant, meaning your optimization efforts should be a constant as well.

Finance & accounting process improvement ideas and tips

Yes, that was a fairly exhaustive dive into the Embark Process Improvement Lifecycle, but we assure you it’s time well spent. Granted, we go about things a bit differently than most but, especially for finance and accounting processes that tend to be under a brighter spotlight than others, we know you’ll quickly come to appreciate how we approach process improvement.

But our lifecycle isn’t all we have to offer on the topic. As promised, we also have a metric ton of various ideas and tips to help you on the process improvement front, besides our previous points on training, technology, buy-in, feedback, and the like. So on that note, let’s just jump right in.

Baby Step Your Improvements

Depending on the state of your processes, you could very well end up with a mountain of to-do’s after your assessment. To prevent yourself and your team from getting overwhelmed, don’t try to take on everything at once.

Instead, initially focus on improvements that will drive the most added value for your company. With a little perseverance, you’ll make it through that to-do list faster than you think.

To prevent yourself and your team from getting overwhelmed, don’t try to take on everything at once.

Focus on Travel & Expense Reports in Your AP

Sure, there isn’t much traveling going on these days for business or otherwise. However, in normal times, travel & expense reports eat-up an inordinate amount of time for your AP department, usually because of approval delays and the volume of transactions.

Streamlining your T&E processes could have an exponential impact on your AP team, freeing up more time than most, if not all, of your other AP processes. Using corporate credit cards rather than reimbursements is another easy best practice that can yield significant results in this area.

A Fast Monthly Close Drives Better Business Decisions

How many different tasks does your monthly close involve? A lot, including a good number of dependencies. When we mentioned focusing on the low-hanging fruit with your process improvements, the monthly close will be near the top of the list for most companies.

A faster close provides more timely, relevant insights for your decision-makers. And that means they will make better decisions since the data they work from is more accurate and reliable.

Technology Isn’t Magic

There’s an old saying about putting lipstick on a pig that’s a touch on the crass side but, given what this best practice focuses on, we honestly couldn’t think of a better intro for this insight.

A process that’s rotten at its core is still going to be bad, even if you apply the most advanced, cutting-edge technology to it. So unless the thought of automating a clunker of a process is appealing to you, it will always be worth your time to get to the root problem first. Because if you don’t, you’ll just end up with a super fast, automated piece of junk. And that’s not great.

Traditional Doesn’t Equal Better

The old, traditional ways often fly in the face of modernized, transformed finance functions that leverage innovation to drive value. And as is usually the case with technology, it’s the early adopters that stand the most to gain.

Just because you’ve done something a certain way since the dawn of man doesn’t mean it’s the best way. When assessing your processes, pay particular attention to those that are more ancient ritual than streamlined workflow. If you do, there’s a very good chance you’ll discover some efficiency gold in them thar hills.

Choose a Solid Task Management Solution

Revisiting the financial close, tasks with many moving parts tend to be complicated, even when they have sleek new processes beating at their heart. An effective task management solution can you help coordinate all of those parts, track timelines, and monitor progress.

Collaboration Needs Communication

Finance doesn’t work on an island. It’s connected to several other departments across your enterprise. In fact, it’s dependent on those departments for key information it uses in its different reports and analyses.

But effective collaboration isn’t automatic. Instead, it’s something you have to actually nurture. Therefore, it only makes sense to make inter-departmental collaboration as easy and painless as possible. The good news is technology makes such collaboration simple with video conferencing solutions, Slack, and other communication tools that are cost-efficient and simple to use.

Yes, we understand this isn’t exactly an earth-shattering tip, especially in these days of remote working and homeschooling. However, with workflow bottlenecks and information silos being so destructive to your productivity, these simple tools can make a massive difference in your team’s efficiency and success.

Final thoughts

If you hone in on anything from this somewhat exhaustive look at process improvement, we hope it’s the two-headed necessity of technology and expertise. Finance and accounting processes are a slightly different breed than others within your organization and, needless to say, an awful lot rides on their success.

That’s what makes Embark such a valuable partner in your ongoing trek to the top of the competitive heap. Our team has a unique combination of skills that brings something different, something better to the table – leadership experience, technical accounting expertise, and decades on the frontlines of accounting and finance functions across the spectrum of industry.

That’s Embark. And we’re here to make your organization more efficient, productive, and successful than you ever thought possible.

Index

- Intro

- What Is Finance/Accounting Process Improvement?

- Process Problems & Challenges in the Finance & Accounting Function

- The Most Common Finance & Accounting Processes Needing Improvement

- The Embark Process Improvement Lifecycle: How to Improve Your Finance & Accounting Processes

- Finance & Accounting Process Improvement Ideas and Tips

- Final Thoughts

Tell us what you need help with

All Embark solutions begin with a conversation. Fill out this form and one of our experts will follow up with a call. We can then better understand your needs and craft the right solution for your organization.

Download PDF

Fill out the form below to download a PDF of this guide.